dusuntua.com is a Malaysian indexing website. Any place used for relaxation, recreation, attracting visitors for holidays, hotels, lodging or place for vacations is listed here.

Login

Member SignUp

Post a Free Ad

Having a problem? Contact web admin

How to post? Step by step

Search by:

|

This listing has been viewed 7123 times | |||||||||||||||||||||||||

|

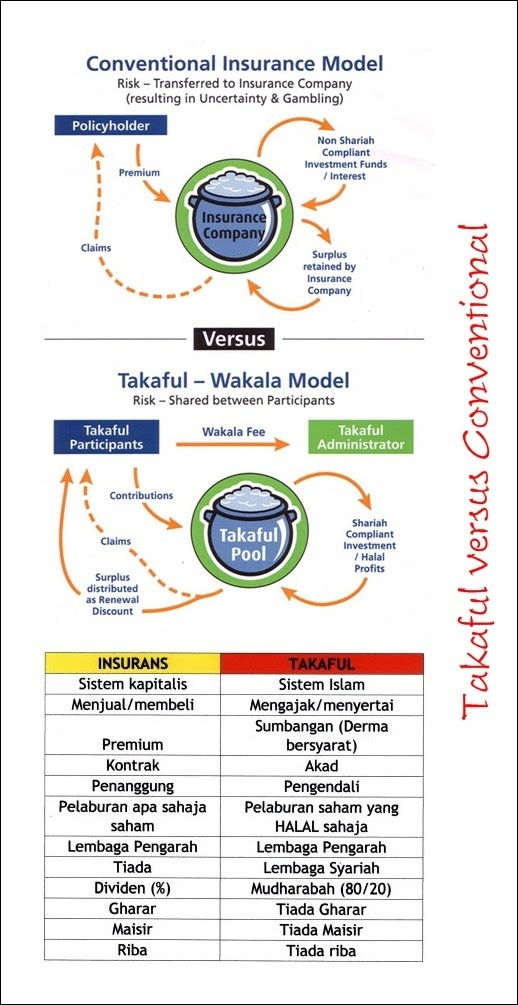

The difference between takaful and conventional insurance

|

|||||||||||||||||||||||||

| ||||||||||||||||||||||||||